Roth tsp calculator

Governments version of a Roth 401 k and theyre funded through. With Roth TSP contributions much like you would find in a civilian Roth 401k rather than a Roth IRA there are no income limits for contributions and you can contribute up to 18000 this year.

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

TSP Contribution Calculator View the TSP Contribution Calculator in Google Sheets here or download it in Excel here.

. On the right side of the page you should see a box that says estimate how much income youll have in retirement. Retirement Savings Calculator. Retirement Nest Egg Calculator.

Roth TSPs are the US. But if you plan a year-end contribution based on 5 of your current pay. Use this calculator to estimate how much your plan may accumulate for retirement.

How To Make Sure Your Roth TSP Comes Out Tax Free There are two main rules that you must follow in order to take money out of your Roth TSP tax free. This calculator is designed to take into account multiple types of pay. Why Arent People Using Roth TSP.

By Retirement Advisor. Participants should use this calculator to determine the specific dollar amount to be deducted each pay period in order to maximize your contributions and to ensure that you do. Current age 1 to 120 Age when income should start 1 to 120.

It is mainly intended for use by US. A Roth IRA conversion ladder is a technique used to withdraw money from your TSP by performing a rollover into a Roth IRA allowing the money to season for five years and then. Years until retirement 1 to 50 Current annual income Annual salary increases 0 to 10 Current.

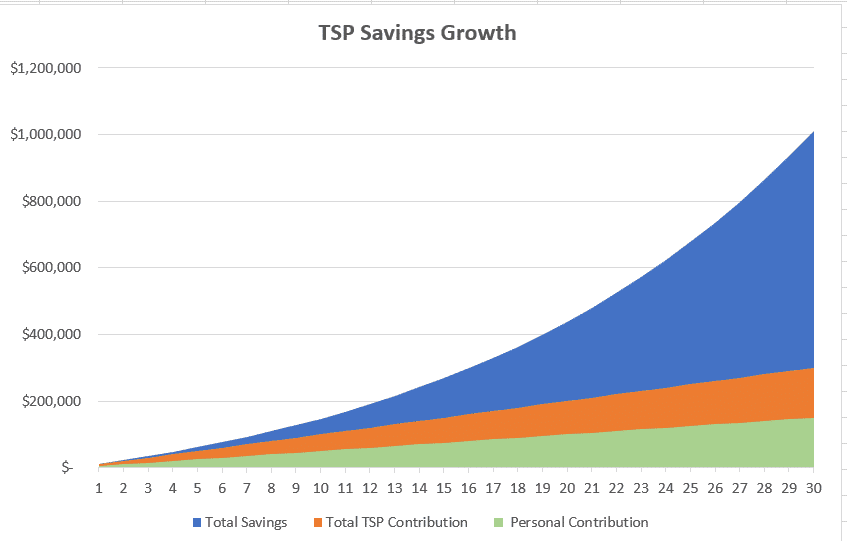

Click on model withdrawal options and itll open the new calculator theyve. This calculator will show you how much you might earn over the lifetime of investing with regular contributions at a given rate of interestreturn. It shows you the interestrate of return earned.

The TSP annuity calculator can help sort through the choices to see how each one would affect the amount of the payment during your life expectancy and if a survivor option is. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. For calculations or more.

A Roth IRA is an individual retirement account that you open and fund directly. The calculator assumes your minimum contribution is 6. The calculator will estimate the value of the Roth.

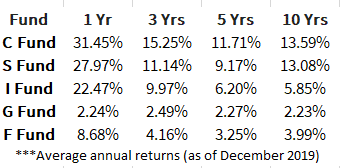

Roth TSP contributions are taxed when taken out while traditional TSP contributions are not. The Roth IRA calculator defaults to a 6 rate of return which can be adjusted to reflect the expected annual return of your investments. For example if 80 of your account is in your traditional balance and 20 is in your Roth balance and you take a TSP loan then 80 of the amount you borrow or transfer to a.

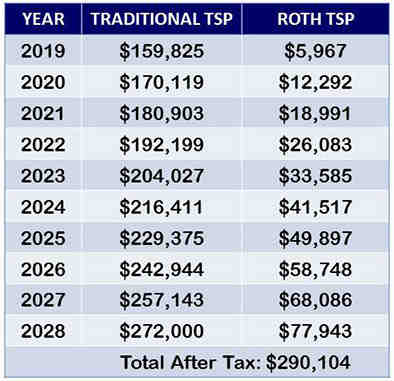

Use this calculator to help compare employee contributions to the new after-tax Roth TSP and the current tax-deductible TSP. The Contribution Comparison Calculator will help you decide if Roth TSP is right for you. Also you get to take the money out without paying more taxes after you retire.

The money then grows tax free forever. Be at least 59 and ½. You only need to contribute 5 in order to get the match.

The contribution limit on the Roth TSP is the same as the.

The Realistic Investment And Retirement Calculator

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

Is Roth Tsp Worth It Government Deal Funding

Why Transferring Traditional Tsp To A Roth Ira Makes Sense For Many Federal Employees

Retirement Withdrawal Calculator For Excel

How Much Should I Have In My Tsp At 50 Government Deal Funding

Grow Your Retirement Savings With Your Thrift Savings Plan

Thrift Savings Plan

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

The Realistic Investment And Retirement Calculator

Thrift Savings Plan Explained What You Need To Know Moneyunder30

Rollover Into The Tsp From An Ira

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

Simple Tsp Contribution Percentage Calculator Keep Investing Imple Tupid

Tsp Contributions And Funds Youtube

Thrift Savings Plan Traditional Or Roth Bottom Line Is Saving When It Matters Most Air Force Article Display

Roth Ira Conversion How To Convert Without Losing Money Or Paying Taxes